Two recent rental scams exposed how easy it is for someone to fake being both a property agent and a landlord — and walk away with thousands in deposit money. It wasn’t a loophole. It was plain manipulation, wrapped in forged documents and a stolen identity.

The damage wasn’t just financial. It left victims stuck, frustrated, and without a place to stay. What unfolded shows just how important it is to stay alert when dealing with property transactions — especially when everything looks too smooth to question.

The Case: Two Victims, One Fake Identity

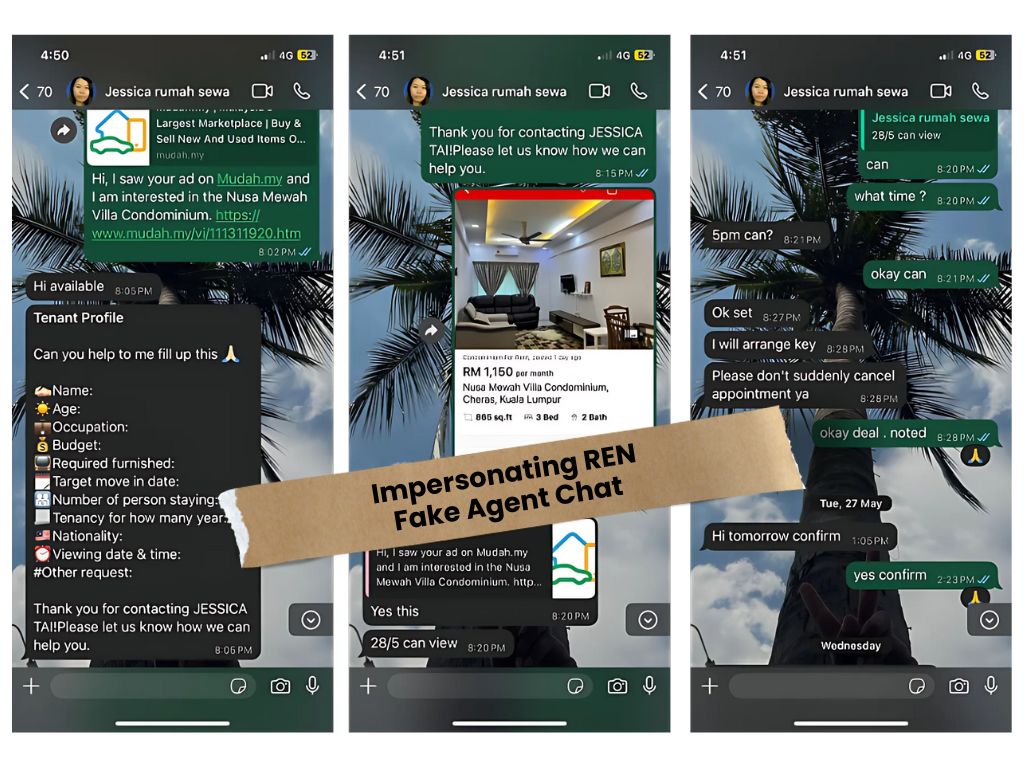

In May 2025, two victims encountered what looked like a genuine rental listing on a popular property platform. The property in question was a unit at Nusa Mewah Villa Condominium, located in Cheras, Kuala Lumpur. The listing was presented professionally and the so-called “agent” responded promptly via WhatsApp. Everything seemed legitimate—until it wasn’t.

The victims were dealing with a woman who used the name Jessica, claiming to be an agent from ARK United Realty. While Jessica is indeed a registered REN under ARK United Realty, she has no knowledge of the transactions nor was she ever involved in marketing or handling the said property.

The real person behind this scam was someone named Celine Tan Yan Yi. Not only was she impersonating a real estate negotiator, she also falsely claimed to be the landlord of the unit.

To complete the illusion, she issued forged documents, including an official-looking Letter of Offer to Rent. The document misused the name and address of ARK United Realty, adding a fake SST number and even listing a fax line that doesn’t exist. The victims paid their deposits—RM2,000 and RM4,525 respectively—into her AEON Bank account. Once the money was transferred, communication ceased.

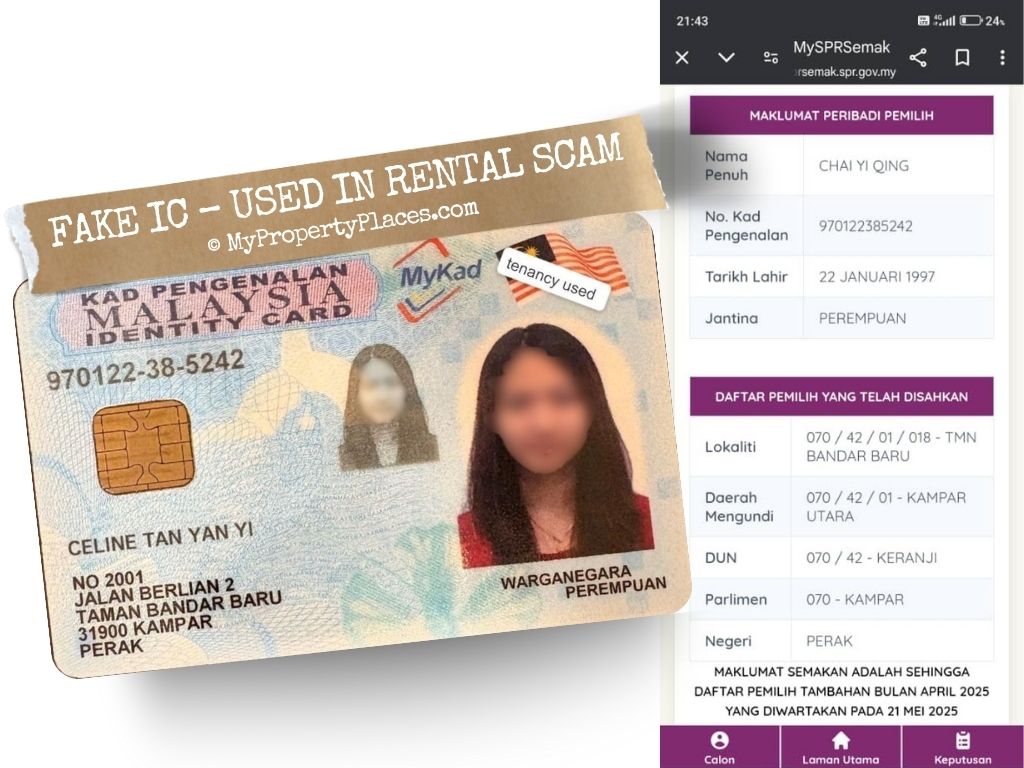

Identity Fraud: A Tampered IC

As part of her scheme, the perpetrator used what appeared to be a genuine Malaysian Identity Card (MyKad) under the name Celine Tan Yan Yi, with NRIC number 970122-38-5242. This IC was shared with the victims during the transaction to build trust.

However, a quick cross-check using the MySPRSemak portal revealed that the IC number actually belongs to a different individual named Chai Yi Qing. This strongly suggests that the IC presented was tampered with, a forged document used to mislead victims into believing in the scammer’s legitimacy.

The use of a falsified IC escalates the gravity of this fraud. It indicates a deliberate attempt to deceive, one that carries serious legal implications.

The Real Cost: More Than Just Money

This scam is a prime example of how far some individuals are willing to go to steal. They prey on people’s hopes, urgency, and trust. The rental deposit represents more than just money—it’s often a person’s savings, perhaps meant to start a new job, begin a new chapter, or secure a safe place for their family.

To the scammer, it might be a quick payday. But to the victim, it’s a betrayal that causes financial strain, emotional distress, and a deep sense of violation.

Why This Scam Worked

Scams like this work because they exploit several common behaviors:

- People trust listings on familiar platforms like Mudah or Facebook Marketplace.

- Renters often feel pressured to act quickly to avoid losing a good deal.

- The impersonator uses real company names, official-sounding emails, and doctored documents to appear credible.

In this case, ARK United Realty was not involved in the transaction and has since issued a public disclaimer denying any affiliation with the scammer or the property. A police report has been lodged, and the matter is under investigation.

How to Protect Yourself

If you’re renting a property in Malaysia, here are steps you can take to stay safe:

- Always verify the agent’s REN number through LPPEH: https://lppeh.gov.my/WP2016/EN/search-negotiator/

- Insist on viewing the property in person before paying any deposits.

- Never transfer funds to a personal account unless verified through the agency.

- Cross-check the property with the actual agency by calling the official office number.

- Be cautious of unusually low rental rates—if it sounds too good to be true, it probably is.

What to Do If You’ve Been Scammed

If you believe you’ve fallen victim to a similar scam:

- Lodge a police report immediately.

- File a complaint with CCID: https://ccid.rmp.gov.my/

- Report the scammer’s bank account to the bank involved (in this case, AEON Bank).

- Contact the legitimate agency whose name was used to alert them.

Final Thoughts: Awareness is the First Line of Defense

The unfortunate truth is that scams like this are becoming more frequent, more targeted, and more deceptive. While authorities continue to pursue these fraudsters, public awareness is our strongest shield.

This incident serves as a stark reminder: Always verify, never rush, and remember that trust must be earned—especially in property dealings.

If you’re unsure about a listing or agent, take the time to double-check. It’s far better to miss out on one rental than to lose thousands to a scammer who never had the right to rent the property in the first place.

Stay informed. Stay safe. Share this article to help others avoid becoming the next victim.

Disclaimer

This article is published by MyPropertyPlaces.com for the purpose of public awareness and education regarding real estate scams in Malaysia. All information presented is based on factual documentation, including police reports, victim statements, and publicly accessible verification tools.

The real estate agency mentioned, ARK United Realty, has granted permission for their name, case details, and clarification to be published in this article. The named agent, a registered REN under ARK United Realty, is not involved in the scam and has no connection to the fraudulent transactions or property.

MyPropertyPlaces.com makes no claims beyond the information provided and does not intend to defame, accuse, or misrepresent any individual beyond what has been substantiated by evidence. Readers are encouraged to do their own due diligence when encountering similar situations.